|

Planned Giving Newsletter

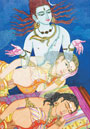

September 2018 Do you have questions about estate planning? Planned giving? Your will? Each month, we feature new articles and interactive features. We also share news about the charitable funds under the umbrella of Hindu Heritage Endowment. The Taos Hanuman Fund, fund #51, will provide a permanent income to preserve the statue and assure that its worship is continued, generation after generation Read more..."How It Works: The Charitable Lead TrustIf you want to provide an inheritance to your children and make a significant charitable gift through your estate, a charitable lead trust can help you accomplish both objectives. The basics. You transfer cash or assets, which are appreciating in value, into a trust you create with the intention of supporting Hindu Heritage Endowment first and then returning the remaining assets to your family. It’s a tool that helps preserve family wealth and control social capital. The major benefits to you. The major benefit is in transferring assets to family members at very little gift or estate tax costs. Using a charitable lead trust, you could potentially pay a relatively small gift tax for eventually transferring, for example, $1 million of assets to your children. This type of gift provides you with a gift tax deduction, not an income tax deduction. Other considerations. There are many issues to consider – legal, financial and personal – when considering the establishment of a charitable lead trust. In the end, you may find that such a trust represents one of the best ways to help Hindu Heritage Endowment while planning a deferred transfer of assets to children. Please call us for more information about this tax-savvy charitable gift. We would be happy to work with your legal and tax advisors to make your dreams a reality. © The Stelter Company The information in this publication is not intended as legal advice. For legal advice, please consult an attorney. Figures cited in examples are for hypothetical purposes only and are subject to change. References to estate and income taxes include federal taxes only. State income/estate taxes or state law may impact your results.

|

Hindu Heritage Endowment | 107 Kaholalele Road | Kapaa, HI | 96746 | USA

www.hheonline.org | 808-822-3012 ext. 6 | Unsubscribe | E-mail : hhe@hindu.org | Donate